Right now there is a growing retirement crisis in America. The numbers paint a worrying picture: half of 55 to 64 year old Americans have less than $14,500 in retirement savings, according to the Center for American Progress. The influx of retiring baby boomers combined with stagnant wage growth and the decline of defined benefit retirement adds extra urgency to this problem.

Only about 47 percent of U.S. businesses offer retirement savings plans to employees. As a result, many Americans don’t feel secure in their financial future. According to The Pew Charitable Trusts, 21 percent of Americans don’t plan on retiring at all, while 53 percent anticipate doing something else after retirement, including continuing to work another job. But for employees of S ESOP’s, retirement with financial security and dignity remains a strong and viable option. That’s because these private companies are owned by their employees, in whole or part, through an employee stock ownership plan (ESOPs).

Typically, companies set up these ESOP trusts and then give employees distributions – often each year – of additional stock in the company. As the company succeeds and its value grows, employees’ ownership stakes increase, providing a healthy retirement savings account

The benefits of S ESOPs are not surprising: when all oars row together, great things can happen. And the data tell a compelling story: these companies demonstrate higher productivity, better resilience in down times, and greater return to their shareholders – the employees themselves, who frequently own 100 percent of these businesses – than other comparable private companies.

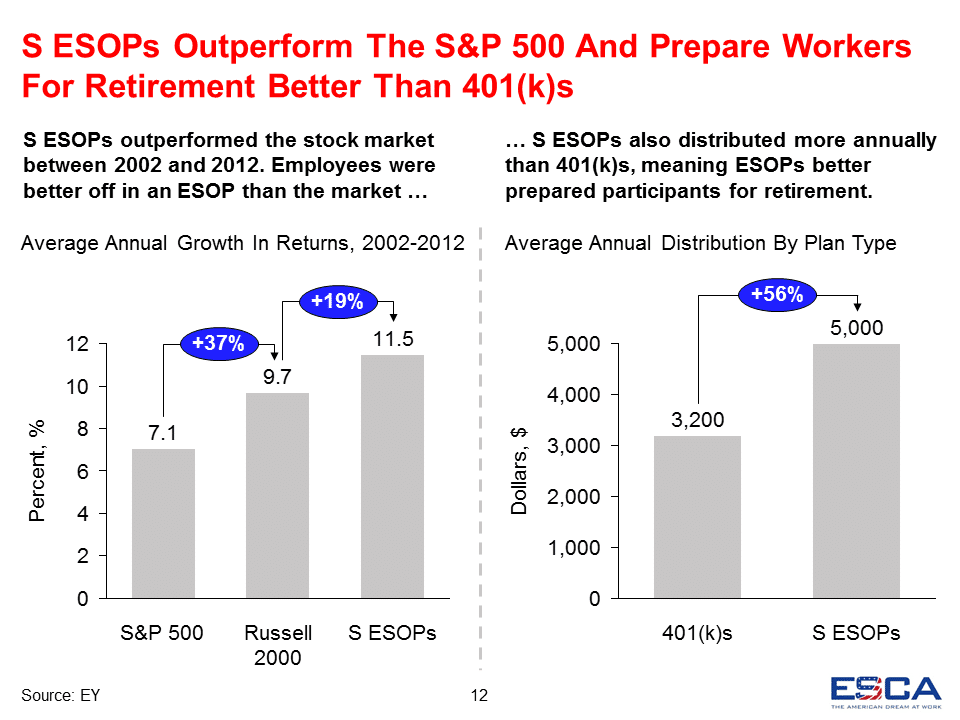

The employee-owners who get a piece of the pie they helped create also generally see these accounts grow faster and substantially larger than a 401(k). Between 2002 and 2012, the value of S ESOP shares held by employee owners outpaced financial industry benchmarks such as the S&P 500 and Russell 2000, according to analysis by Ernst & Young. Over this time period the value of S ESOPs grew by an average of 11.5 percent annually, compared to 7.1 and 9.7 percent for the S&P 500 and Russell 2000, respectively.

Companies that are mostly or wholly owned by their employees also tend to develop a culture that is more employee-centric, so it’s no surprise that The American Action Forum found that S ESOPs pay their workers on average 22.2% more than other firms – adding even more to employees’ ability to build their nest eggs.

For the same reasons, S ESOPs are also more likely to offer their employees a second retirement plan, like a 401(k), than other firms are to offer a first retirement plan. Sixty-five percent of S ESOPs offer a second plan compared to 45 percent for the average firm, according to Ernst & Young. This adds another layer of savings for employee-owners that many workers at other firms don’t have access to.

Currently there are 470,000 employee-owners of S ESOP companies across America who are closer to securing their retirements due to the S ESOP business model. The promise these businesses hold cannot be ignored when considering how to address the growing retirement gap.